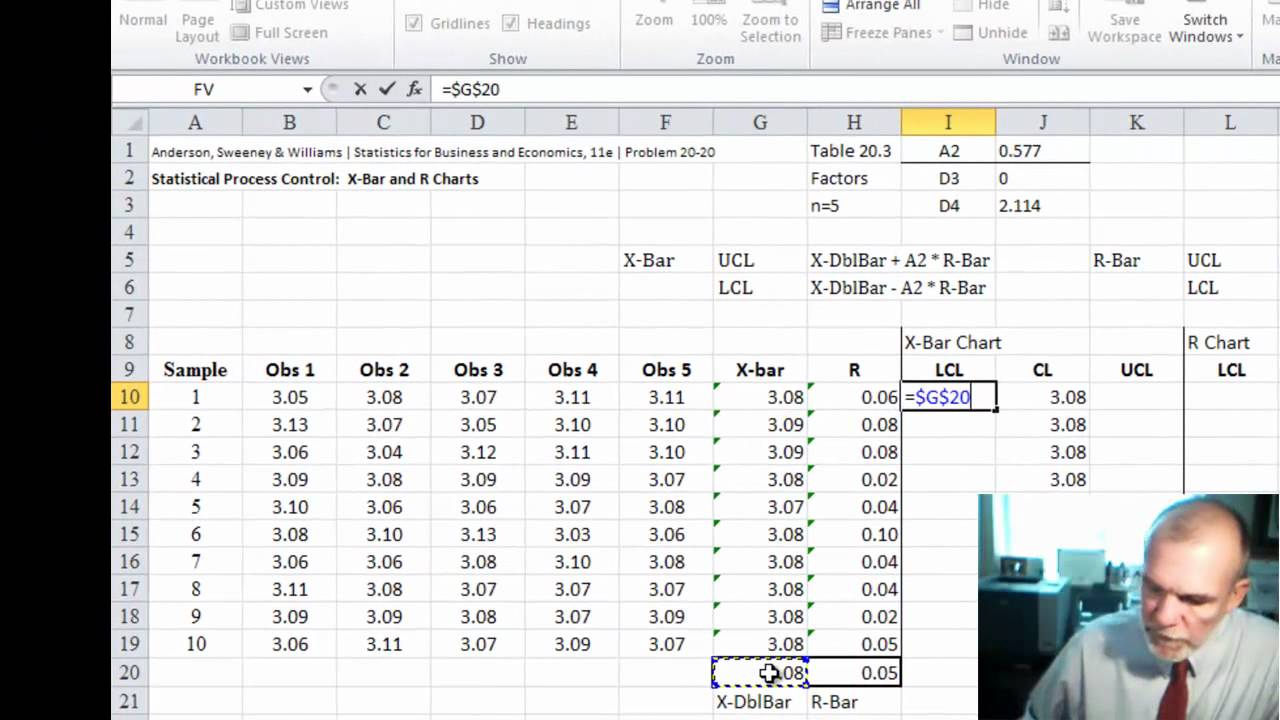

Likewise, the second moving range (MR 2) is the absolute value of the difference between the 2 nd and 4 th values and so on. In this case, the first moving range (MR 1) is the absolute value of the difference between the 1 st and 3 rd values. We can also compute MR-Bar based on a Moving Range of MR=3. Likewise, the second moving range (MR 2) is the absolute value of the difference between the 2nd and 3rd values and so on. For example, the first moving range (MR 1) is the absolute value of the difference between the 1 st and 2 nd values. Control Chart Constants – E2īecause d2 is a function of the Average Moving Range (MR-Bar), we often compute MR-Bar based on a Moving Range of MR=2. Take special notice of the expression 3/d 2. Since n=1, notice that the sample size, n, does not appear in equation (6). In this case, we can change equation (4) and use the following expression shown in equation (6). When using an Individuals Chart the subgroup sample size is n=1. Let’s apply this new-found knowledge to derive the E2 constants used to compute the control limits for an Individuals Chart. Control Chart Constants – Individuals Chart We can use these d2 and A2 values to calculate the control limits for the X-Bar Chart. In Table 1, shown are the d2 and A2 constants for various samples sizes, n=2 through n=7. Control Chart Constants for A2 at n=2 thru n=7

XBAR FORMULA HOW TO

To learn more about the d2 constant and how you can derive the d2 constant read the following post Range Statistics and d2 Constant – How to Calculate Standard Deviation. Without it we cannot estimate the control limits using equation (4). The X-Bar chart and Individuals chart both use A2 and E2 constants to compute their upper and lower control limits. Substituting these values into equation (5) we have: Let’s assume that we want to build control limits using a sample size of n=7. In this case the d2 constant is d2=2.326. Let’s assume that we want to build control limits using a sample size of n=5. Control Chart Constants for A2 at n=5, n=7 Once we know the sample size, n, we can find the value for d2 and compute the value for A2. The A2 constant is a function of the sample size n. Take special notice of the expression 3/d 2√n. Risk and volatility can also be reduced in a portfolio by pairing assets that have a negative covariance.ġ: Compute the value of covariance i.e Cov(x,y) for the given data set.We now have the final equation to compute the control limits for the X-bar Chart based on the average range (R-bar). When two stocks tend to move together, then they are seen as having a positive covariance when they move inversely, the covariance is basically negative.Ĭovariance can be a significant tool in modern portfolio theory used to ascertain what securities to put in a portfolio. The covariance of X and Y is defined as -Ĭov(x,y) = \Ĭovariance is known to be a statistical tool that can be used to determine the relationship between the movement of any two asset prices. Negative Covariance - This tells us that the two variables tend to go about in inverse directions.ĭefinition: Suppose X and Y are random variables with means µXand µY. Positive Covariance - This tells us that the two variables are supposed to go in the same direction.Ģ. These given values can also be known as the following:ġ. One more thing to note about covariance is that it might produce positive as well as negative values of variables.

As the word itself suggests, Co-variance, lets different variables correlate and vary.Ĭovariance is somewhat related to variance The difference is just that 'variance' talks about a single variable, whereas 'covariance' talks about two variables. This helps us figure out the changes in different variables. Covariance is a part of statistics and it is the measure of the relationship between two random variables or random problems.

Statistics is a major phenomenon in mathematics and all of us have studied it in all forms.

0 kommentar(er)

0 kommentar(er)