You use up and repay the borrowed money as needed. Like a credit card, a business line of credit only requires you to pay interest on the amount of money you borrow, not your entire credit limit. CDC/504 Loan: Long-term, fixed-rate financing for major fixed assets (i.e., equipment or real estate).Microloans: Small loans, between $10K and $50K these loans are ideal for startups who need a modest boost.7(a) Loans: SBA's primary loan program loan amounts are usually between $350K to $5M.Government.īorrowers apply for an SBA loan with private lenders and are usually secured, meaning they require collateral.

Review the details to see which works best for your business.Īn SBA loan is backed by the Small Business Administration, an agency of the U.S. The four business loans below represent the majority of financing that small businesses get.

Find out which small business-friendly bank account is best for your business. Don't let your checking account be part of the problem. Check any loan contract for mention of prepayment fees.

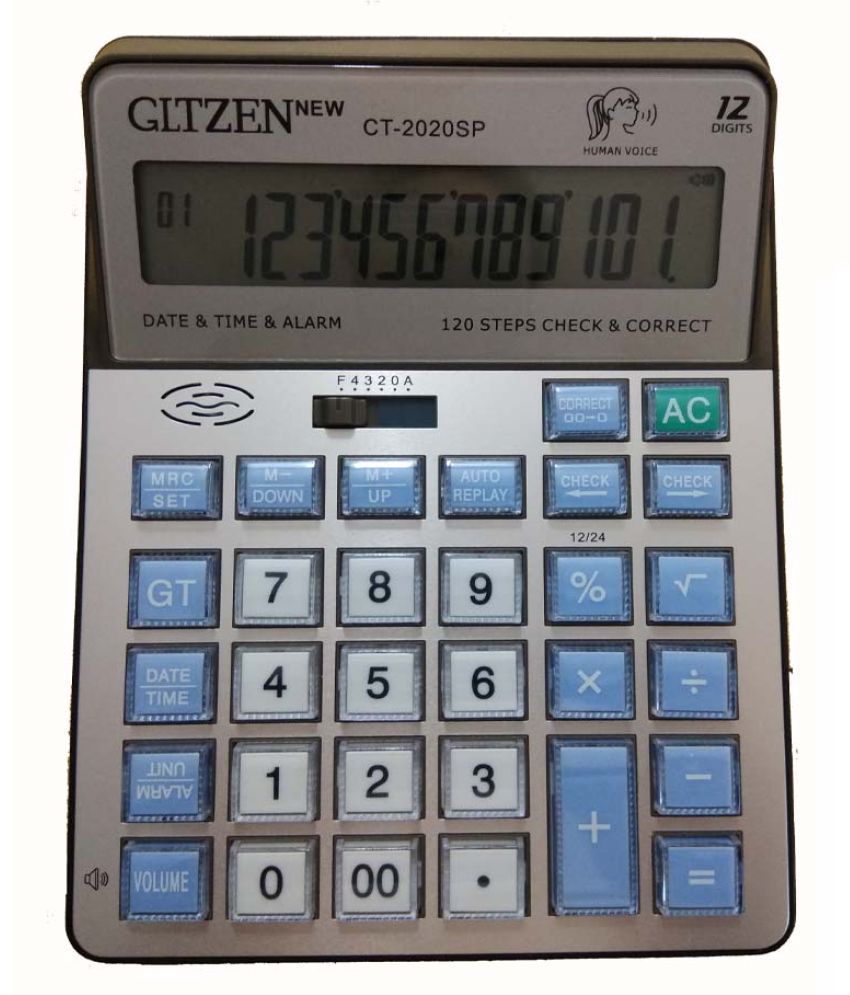

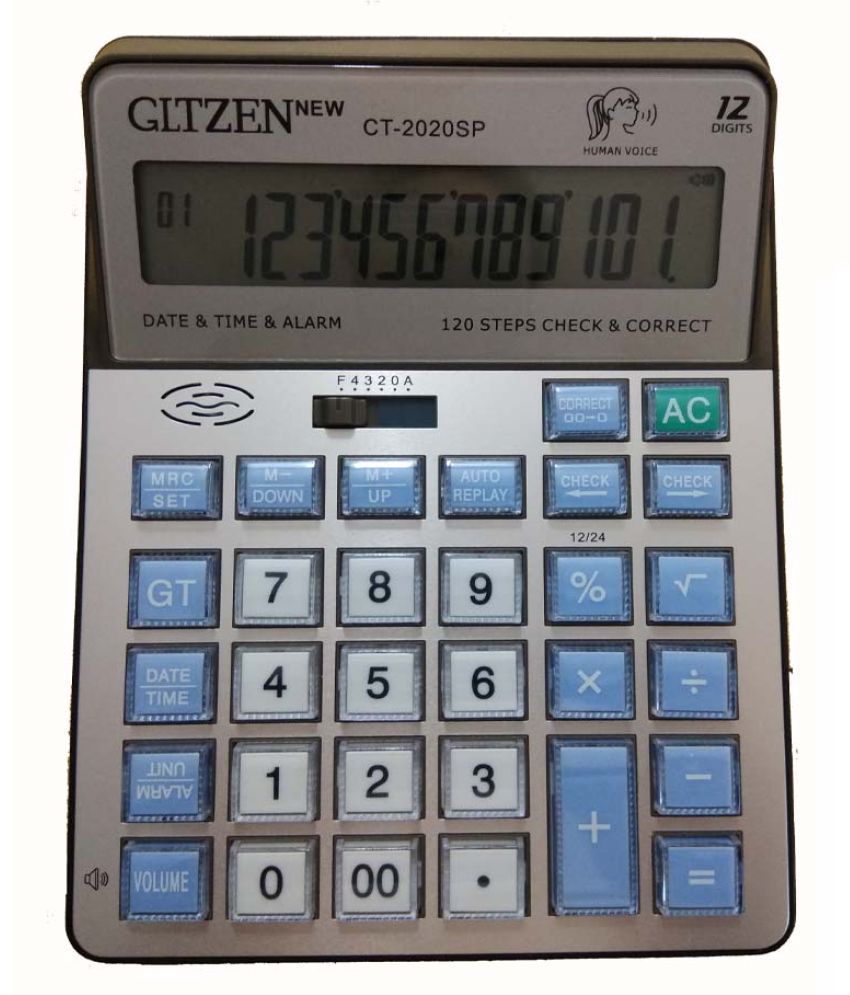

Prepayment fee: Some lenders charge this if you pay your loan off early because they lose out on your interest payments. Wire transfer fee: Lenders charge this if you make a payment via wire transfer. It can be a flat fee ($10 - $35) or a percentage of your outstanding balance (2%-5%). Late payment fee: Charged if your payment is made past the due date (or grace period). Non-sufficient funds fee: Charged if your loan payment doesn't go through. It can be charged monthly as a percentage of your monthly payment or yearly as a percentage of the total loan amount. Service or processing fee: Lenders charge this to cover the cost of processing your payments and managing the loan. Underwriting fee: Lenders charge this to pay for the time and labor associated with underwriting your loan application. SBA loan guarantee fee: The SBA charges this fee because they guarantee lenders that 70%-80% of the loan will be paid back, even if you default on the loan. Referral fee: Loan "marketplaces" may charge this for referring your loan application to lenders. SBA lenders and lending platforms will usually charge a packaging fee instead of an origination fee. Packaging fee: Similar to an origination fee. It is usually a percentage of the loan (1%-6%) Origination fee: Lenders charge this for processing your loan application and to pay for any costs associated with verifying your info (like a background check). Here's what you should know:įees Charged at the Beginning of the Loan Like most loans, business loans come with several fees that you should be prepared for. The less interest you pay = the more you pay on principal = the faster the loan is paid off. This not only shortens your payment schedule, but it also reduces the amount of interest paid each month. Not liking the numbers you're seeing? Consider going back and adding extra payments. This breaks down how each monthly payment is split between principal and interest. the interest.įor more detail, check out the amortization table below the pie chart. This tells you how much of your payment total went toward the principal vs. You'll also see your Total Payment amount displayed in a pie chart.

Hit "Calculate" to see your Monthly Payment amount and the Total Months you'll be making the payment. That way, you can see how much your minimum payment ends up being and decide whether you'll be able to pay more. This is money that you can pay on top of the minimum payment.

Finally, you have the option to enter any Extra Payments. This is how long you'll be paying off the loan. Then, enter the Term of the loan in years. If you haven't started your search yet, enter between 3%-7%.

If you've shopped around with specific lenders, enter the rate you've been quoted. Next, add the Annual Interest Rate that the lender will charge on the loan.First, enter your desired Loan Amount that you want to borrow.The calculator above breaks down your payment schedule and how much total interest you'll pay.

Business finance calculator how to#

How to Calculate a Business Loanīefore you apply for business loans, it helps to know what you're getting into. Plus, review what fees you can expect to pay and popular business financing options to choose from. Find out everything you need to know about business loans in this guide.

0 kommentar(er)

0 kommentar(er)